What Every Dietitian Billing Medicare Advantage Plans Needs to Know

Navigating the complexities of Medicare Advantage plans can be daunting for dietitians. Understanding what every dietitian billing Medicare Advantage plans needs to know is essential for ensuring proper reimbursement and compliance. These plans, also known as Medicare Part C, offer an alternative to traditional Medicare and often have the SAME coverage rules and requirements for MNT. This article will provide key insights for dietitians on billing Medicare Advantage plans effectively.

What Diagnoses do Medicare Advantage Plans Cover?

Medicare Advantage plans are Medicare plans offered by private insurance companies approved by Medicare. These plans provide at least the same level of coverage as traditional Medicare Part A and Part B but may (although NOT often) include additional MNT benefits. It’s crucial for dietitians to verify the specific benefits and coverage details of each Medicare Advantage plan their patients are enrolled in. Additionally, this verification process helps avoid surprises and ensures that services provided are covered.

I have been billing Medicare Advantage plans for the last two decades. I know that is a LONG a** time. With that being said, they seem to cover the same diagnoses as Medicare for MNT. Therefore, they cover diabetes, CKD stages 3a, 3b, 4 and 5 non-dialysis. In addition they cover 3 years status post kidney transplant. Furthermore, I have also seen a small handful of plans cover additional diagnoses. However, I would confidently state most Medicare Advantage plans cover the same MNT ICD 10 codes as a traditional Medicare plan does

What type of limits on MNT do Medicare Advantage Plans Have?

In my personal experience Medicare Advantage plans follow the same limits as straight Medicare plans. They also utilize the same CPT codes and follow the EXACT same rules as traditional Medicare plans.

Do Medicare Advantage Plans cover Obesity?

One of the biggest mistakes I see dietitian make is assuming obesity is a covered ICD 10 code in a private practice setting. And while it actually is RDs in private practice are not eligible providers. To learn more about this mistake click HERE to read a recent blog on IBT.

How do Medicare Advantage Plans Work Relative to Network Status

Every dietitian billing Medicare Advantage plans needs to know is the importance of understanding the plan’s network requirements. To successfully bill a Medicare Advantage plan for MNT there are specific requirements. The dietitian needs to be in network with BOTH Medicare AND have a contract with the Medicare Advantage. If you are just a Medicare provider and not in network with the commercial side of the plan you can’t bill this plan. If the patient has a qualifying diagnosis you can’t see them. You need to refer them to an RD provider who is in network with the patient’s Advantage plan.

Want this content in video format? Click below to watch my YouTube Video on What Every Dietitian Billing Medicare Advantage Plans Needs to Know

WHICH plan do we bill for Medicare Advantage Plans?

The dietitian must submit the claim to the commercial payer. For example if it is an Aetna Medicare Advantage Plan the we submit the claim to Aetna. Or for example if it is an United Health Care Medicare Advantage Plan the claim we submit the claim directly to United Health Care. We never submit an Advantage Medicare plan directly to Medicare. No reimbursement is made to the dietitian when they submit to the incorrect payer.

Summary

In conclusion, for dietitians looking to optimize their billing practices with Medicare Advantage plans, understanding these key points is essential. Staying informed about the specific plan requirements, knowing who to bill, and when are all critical components of successful Medicare Advantage plan billing.

Does the Medicare process feeling SUPER duper overwhelming?

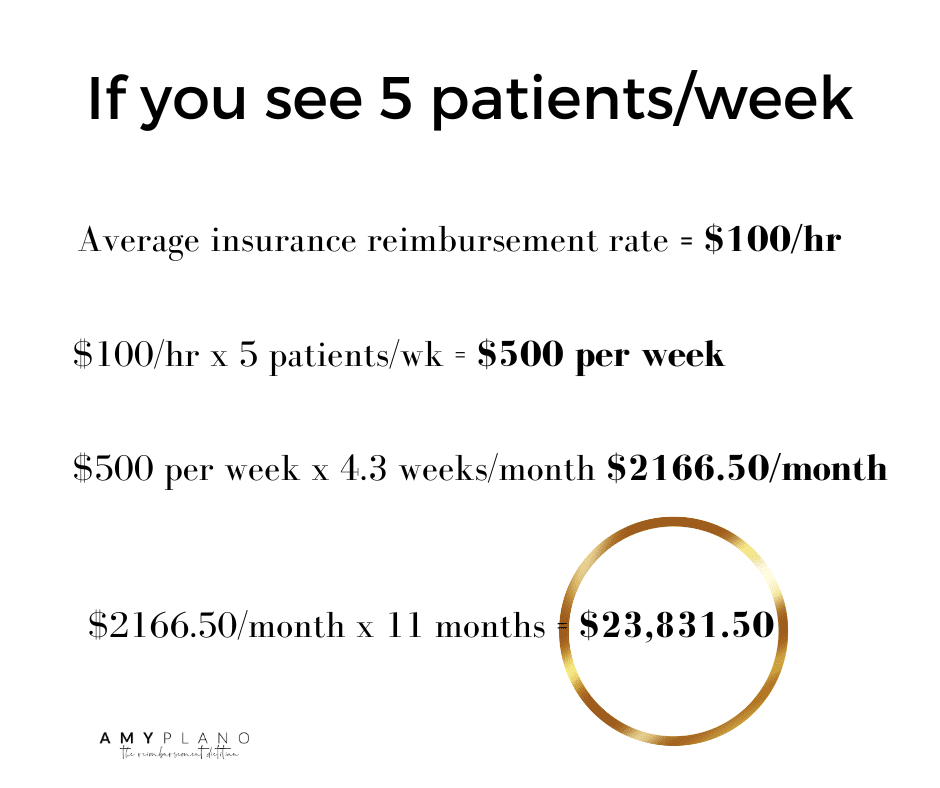

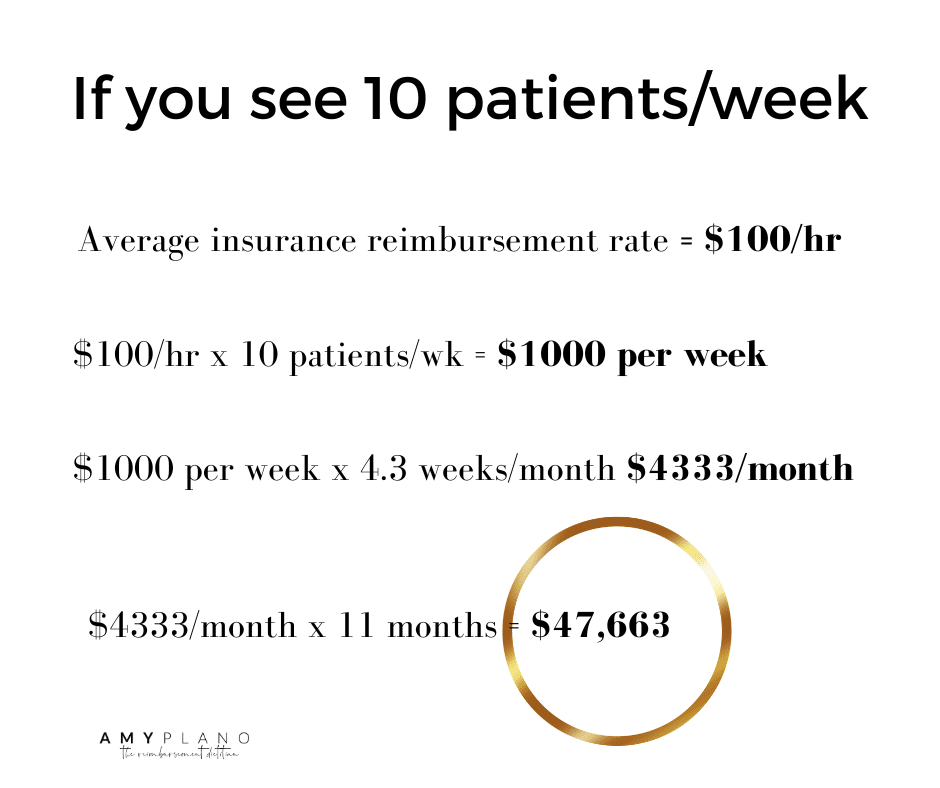

My Reimbursement Coaching Program walks you step by step through EVERY single aspect of Medicare reimbursement.

Click HERE to put in an application and go from a scared, frightened Medicare Newbie to a confident, rock star Medicare billing Ninja.

For more tips and resources on billing and reimbursement, dietitians can follow my Instagram @reimbursement_dietitian

By mastering these aspects, dietitians can enhance their practice and provide better care for their patients.